The illusion of money

Over the millennia money has changed from a concrete medium of exchange to an illusion in a virtual electronic world that can affect reality. In the twentieth century debt led to an expansion of the global economy and carelessly managed debt and over optimistic fractional reserve banking led to economic bubbles that burst in the latest recession. Arguably the bursting of the bubble served the interests of politicians employers and the finance industry, though it is perhaps going too far to argue that the recession was choreographed in advance.

The confidence Trick we need

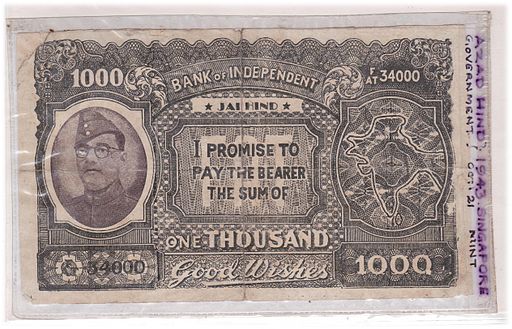

Hold a banknote in one hand. In the other hold a piece of paper the same size. Now, ask yourself what is the difference? The difference is a gigantic willingly accepted confidence trick, essential for society as we know it to keep functioning.

Customers pay money into a bank. At one time they paid a monthly fee for bank services. Nowadays the services are paid for by fractional reserve banking. Only a small percentage of the money a bank holds is withdrawn by customers on any one day. Banking is free to customers because the bank is allowed to invest a portion of the remaining capital, normally by lending it to people at interest. Fair enough, as long as a bank keeps a float large enough to handle day to day transactions, and a reserve for unexpected fluctuations this sounds brilliant. And by investing in new businesses they boost the economy, promote entrepreneurialism and create the jobs that keep the majority of the population able to pay their way and generate the bulk of government revenue.

But it doesn't seem to work like that.

All the good things mentioned arise because we accept the promise written on our banknotes, and believe we can always get our money even though the bank has lent most of it to other people like us. “Other people like us”!! Given that we tend to elect politicians who are like us and that dodgy neighbour who always has a wad of notes, that alone should make us pause.

The need to create Debt

Banks nowadays are almost all public limited companies (private banks are still available for the very rich) which have responsibilities to shareholders and none to customers or the wider community. They therefore have an incentive to boost profits, and dividends, by lending widely. In this respect they are in competition with other lenders such as Credit Card Companies and Payday Lenders. The latter take higher risks and charge much higher interest rates, some 4000% compared with maybe 5% charged by a bank.

Since the recession there has been pressure to separate investment banking from retail banking which means about the only way banks can invest spare capital is by lending money, the stock market or even government bonds being forbidden to them. This is a result of the natural anger over investment banks that invested recklessly using creative derivative products and, when the crash came, were deemed too big to fail and subsidised in part by the High Street arms of their parent companies. Separating high risk Banking from the High Street makes sense but banning investment other than creation of Debt leads High Street banks to create Debt. Since they are competing with other lenders there is pressure to lend to higher risk borrowers and this, as has been shown in the last few years, poses a risk to the entire community.

Money that is lent to one customer and paid into another bank becomes the other bank's capital. It can then be lent out. This results in a cascade of newly created fairy gold that can vanish the moment the bank at the head of the chain decides to foreclose.

Debt and Slavery

Let's be clear. Banks are businesses and their product is money. You probably pay nothing for banking and forget the rule that if it is free you are the product not the customer. No point arguing that you are paying by letting the bank use your money instead of you investing it yourself.

Much of society as we know it is shaped and run by those who manage Money, and of course they manage it in a way that increases our dependence on money, just as the earliest safety razor makers gave away a razor and a packet of blades knowing the user would become dependent on them:

Today debt is an integral part of personal financial planning in developed countries, and a scourge and barrier to development in the third world, though microfinancing initiatives are slowly combating this.

Thirty years ago most people tried to avoid debt.

Three hundred years ago you could be imprisoned indefinitely without trial for not paying a trivial debt.

And in the third world generations are in Debt Slavery.

Though they do not know it, most of the people in developing countries are wage slaves because they are in debt, which makes them debt slaves.

We have abandoned the extended family, the clan and the tribe, which for all their faults provided some protection against a power hungry central state and reduced the need to go into debt to the finance industry, leaving the extended family to “primitive” third world countries, so pensions are essential retirement provision and Insurance is becoming equally indispensable. All this means increasing power for the financial services industries.

Once upon a time none of these things were needed.

And the shocking thing is that Money has become an Illusion.

Before looking at how this happened it is necessary to look at the kind of people who run Money.

Slavemasters of the Universe

After studying psychopaths in prisons the inventor of the Hare Psychopath test decided he should have spent more time in the stock market. It turns out that the qualities needed for success in the finance industry, including lack of fear ( often mistaken for bravery), Grandiosity ( mistaken for self confidence) and lack of Empathy ( mistaken for the ability to make tough but painful decisions) are traits of psychopaths and sociopaths: there are reports that some Investment banks actively seek to employ psychopaths. Since former employees of big players in the investment industry seem to be increasingly in influential roles in politics, it is increasingly likely that international affairs are being decided by people with psychopathic tendencies.

Given that psychopaths do not feel emotions much or care about anyone else it would be natural for them to gravitate to areas where they can gain power and or money as compensation for feeling. For the smart psychopath this means politics or finance. Some of course move into crime, but the lack of fear makes them careless and they tend to be killed or caught.

Since Debt is slavery, it seems fair to call such people slavemasters.

The Prehistory of Money

At one time none of today's financial products were needed. Even money was not needed. Money developed as a medium of exchange that simplified trade. To a hunter-gatherer society wealth is a burden carried on one’s back and so kept to a minimum, and sharing benefits everybody so a non altruistic sharing of wealth is common. To a Nomadic society wealth is carried by beasts of burden that may themselves be wealth and traded as money, or may be held as communal property.

With Agriculture people could settle in one place and accumulate wealth. Whether reindeer, cattle, corn or land wealth must be tallied and tracked, especially if entrusting others with the task of managing it. A strong case can be made for attributing the invention of writing, at least in the Middle East, to landowners' stewards, the equivalent of accountants, who had to keep account of their master’s wealth. But with writing came the one of the seeds of the Illusion. The reality of wealth could be replaced by records of wealth offering new possibilities for legitimate and illegitimate manipulation of the records.

Originally money, like wealth, was tangible. Gold, Iron Bars, bags of salt - in the days when salt was hard to extract. All these and more were used as a medium of exchange, portable wealth that allowed trade to continue. But this could not continue for ever.

Coins

Coinage was next. Rare metals, validated by the head of state, who would put their portrait on a coin. This was also an excellent way to remind everyone who was in charge. Since coins were of different sizes and metals in each state exchange rates were born. So were forgery, coin clipping, sweating ( shaking coins in a bag till a dust of fine precious metal was left in the bag and currency debasement.

When the nominal value of a coin fell below the value of the metal it was made of people started melting coins. This happened in the 1970s when people realised that pre 1947 silvers coins in the UK were worth more than their face value. Some sharp people made a lot of money seeking out these coins and selling them for scrap. Then more by publicising what they had done just as the supply started drying up.

To deal with the difference between the real and face value of coins governments mixed base metals with rare ones when making coins, and eventually used only base metals. It has been argued that such currency debasement contributed to the fall of the Roman Empire as, when the face value of a coin exceeded the value of the metal in it, prices tended to rise because people tried to get the same weight of gold or silver for their goods. It was only in the latter half of the twentieth century that the confidence trick reached its full strength: almost all coins, other than those issued especially for the benefit of collectors, are now base metal. In any case coinage was another stage in the transformation of Money into Illusion. The reality of rare metals was replaced by the illusion that cheap metal disks were worth more than their scrap value.

Banknotes

Banknotes started as promises by banks to pay a certain amount of gold or silver to the bearer. Such promises live on as bearer bonds, bank drafts for vast amounts of money to be paid to whoever presents the bonds. They are less popular today as they offer a virtually untraceable means of transporting wealth. This causes difficulties for tax collection, and dealing with other types of crime. Banknotes could now be treated as money and banks could “print” money. By gambling that only a small proportion of their customers would ever withdraw their money banks could create notes to a far greater value than their gold reserves.

With gold locked away in reserves and money circulating as notes, banks could treat customers wealth as mere records in ledgers. Transferring money became mainly a paper transaction. Wealth, to a bank, became a figure in a record book. The transition of money from portable wealth to paper bound illusion was nearly complete.

Private and Fiat Currency

Private currencies are issued by private organisations while fiat currency is issued by governments and central banks. In many countries only fiat currency is legal. There are over 4,000 privately issued currencies in 35 countries, from local paper money to electronic currencies [3]. At least one trend observer has claimed that private currencies will come back into widespread use. The point to note here is that all such currencies are based on trust rather than the intrinsic value of the tokens used for exchange and are only as real as the trust that exists.

Stocks, Shares and the Money-Go_round

The growth of stock and financial exchanges completed this transition. Now money could be made not just in business, or by investing in someone else’s business, thus creating wealth but by buying and selling shares in various businesses. This allowed companies access to far more capital than they could get from any one investor but the complexity of managing the resulting corporations – now legally separate from the investors - allowed the managers the shareholders used to protect their investments to take control of the corporation. In any case the reality of a bricks and mortar business was replaced by paper tokens and the illusion of ownership.

With the growth of the foreign exchange market Money itself was for sale. By selling one currency for another, and performing a daisy chain of transactions a shrewd operator can end up making ( or losing) a lot of money in the original currency. Today these deals, the paper transfer of Illusion from one form into another can even bring down governments. And large organisations can legally avoid paying tax. As an example one such organisation, mentioned in Private Eye 1324 , earns around £2 billion, much from the British taxpayer. They recently transferred their intellectual property from Switzerland to an Irish subsidiary. The move was via Luxemburg and so was tax free. In Ireland they are getting tax relief on the £4 billion pound costs of appparently buying the intellectual property from themselves. Meanwhile in the UK their tax bill is around £3 million pounds.

Illusions are profitable.

Economics: pseudoscience and dogma

Perhaps the supreme example of the power of Money as illusion is Classical and Neo-Classical Economics, a “Science” with virtually no observational or experimental backup for its theories, theories based on 19th century physics and, if any attention is paid to data, raw data which generally is so imprecise and poorly defined as to be worthless. Yet, because of the doctrinaire application by governments of economic theories they only understand imperfectly- the latest being the theory of the Free Market, millions of people have been plunged into poverty while the Money People and the Upper Classes get richer, but given the herd mentality and the bandwagon effect once a fashionable economic theory is adopted holders of older or rival theories are derided as incompetent or politically motivated, a classic example of Jungian Projection. Supporters of the new theory display a fanaticism that should have died with the middle ages together with treatment of rivals differing from the way the Church treated “heretics” only in being non lethal and letting the “heretics” walk freely.

Winding up

Perhaps Money is the Prince of Lies supreme creation, and obsession with money is indeed the root of much ( but not all) Evil, but that would be oversimplifying matters.

Money seems to be a creation of Mara, the lord of illusion, or, if you prefer a Christian perspective, of the Prince of Lies.

Of course the full story is more complex. Money is not in itself evil, even if some people do evil things through love of money, and it has been one of the motors of social evolution. If everyone stopped believing in Money society might collapse.

Sometime in the 1970’s a friend of mine taught his children the value of money by burning a hundred pound note. before their eyes. As they tried to rescue the note he pushed them back. When it was finally consumed he told them Money is to be treated with respect and contempt.

The way to deal with Money as illusionary is to educate the public to treat money and economic theories with respect and contempt. But really educating the populace is the last thing any state wishes. Education lets people think effectively for themselves and then they get harder to govern, perhaps becoming subversives, once defined by the home secretary of a Labour government allegedly dedicated to freedom, as “anyone who causes problems for the government” . But that is another kettle of rotten fish. Till the state loses its fear of educating the populace properly, and purple pigs fly through the sky singing Grand Opera, we must rely on burning banknotes in front of our children.